Crowded Markets

"Be Fearful When Others Are Greedy And Greedy When Others Are Fearful"

Warren Buffet on Fear and Greed

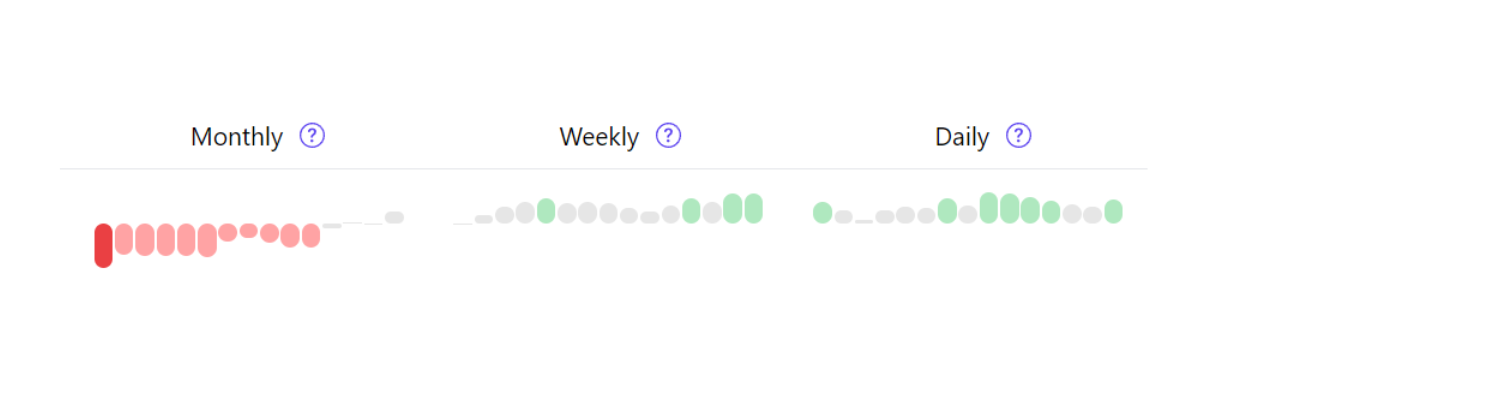

Our proprietary Crowded Markets system is an intelligent capital allocation feature which track Fear and Greed across Monthly, Weekly & Daily Intervals for every asset listed in the platform! They are designed to eliminate emotional trading decisions by showing the points at which other traders are themselves becoming emotional when trading an asset

By highlighting the points at which other market participants are becoming emotional (Fear and Greed) when trading an asset, the Crowded Markets system allows you to easily see when an asset is becoming overcrowded to the upside or the downside. These readings often mark cyclical trend highs and lows in each asset with a 70% and 95% expectancy.

This key feature not only safeguards you against buying the highs and selling the lows, but also offers high probability profit taking areas for trades you may already be involved in. Let’s look at the Hedgedash Crowded Markets scanner in more detail…

Time Horizons

Crowded Markets monitors Fear & Greed across 3 separate timeframes. Daily, Weekly, and Monthly (Presented in the platform in reverse order beginning with Monthly to allow you assess markets in a progressively more granular fashion)

With the monthly Crowded Markets Algorithm, each bar represents a month, with the far right bar representing the current day, moving back in time, month by month as you move to the left. Likewise, the bars in the Weekly and Daily gauges represent a week and day respectively.

Categories & Colours

As the bars extend either upwards or downwards from the centre point, they will change in colour accordingly.

Each colour represents a different status of Fear, Greed or neutrality:

Grey NEUTRAL

No strong indication of Fear or Greed

Light Green GREED

Some indication of Greed is entering the market. Approximately 68% chance of the market pausing or reversing from here.

Dark Green EXTREME GREED

Strong indication of Greed in the market. Approximately 95% chance of the market pausing or reversing from here.

Light Red FEAR

Some indication of Fear is entering the market. Approximately 68% chance of the market pausing or reversing from here.

Dark Red EXTREME FEAR

Strong indication of Fear in the market. Approximately 95% chance of the market pausing or reversing from here.